Background

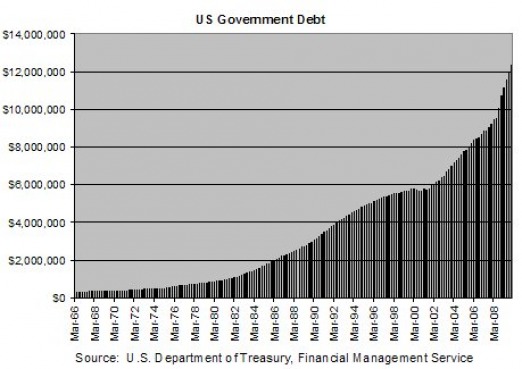

The United States government has held some form of debt since its conception, but it did not start to rapidly grow until the 1960's. While the U.S. sustained significant debt during World War II, it was quickly able to pay off much of its lenders as the economy boomed with post-war production and consumption. It was not until the 1960's, as U.S. consumption levels rapidly increased that imports also increased, leading to the United States' trade deficit. The growth in U.S. trade deficit, fueled by consumption has led to a growth in U.S. debt as shown in the graph below.

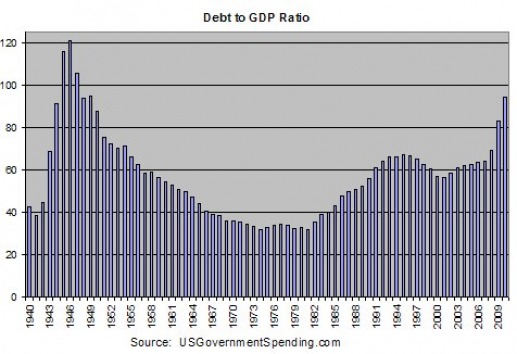

Not only has debt grown over the past seven decades, but the U.S. Debt to GDP ratio has also been in constant flux. Post WWII, Debt/GDP was at its highest on record at 117.5%. This ratio, while high, was also deemed appropriate given the necessary spending during the war. After World War II ended, consumption increased as veterans returned home, and the manufacturing sector quickly transferred its primary goods from weapons and war goods to car manufacturing and other consumption goods. This led to the rapid decrease in the Debt to GDP ratio that occurred through the 1970's, as seen on the graph below. However, as the trade deficit continued to grow it was inevitable that the United States would need to take on more debt. As it turned out, debt was taken on at a faster rate than GDP was growing, leading to the increased Debt/GDP that has occurred ever since the start of Ronald Reagan's tenure in office. When President Obama took office in January 2009, the Debt to GDP ratio was 83.4% (Whitehouse FY 2011 Budget, Figure 7.1). According to a recent Washington Times article, the Congressional Budget Office foresees Debt/GDP to exceed 90% by 2020 and fears that the United States government is on track to create Debt to GDP ratios that could reflect war-time levels outside of an active war occurring.

The Facts

So the big question becomes, why does the U.S. government have to take on debt at all? There are several factors that impact growth in government debt:

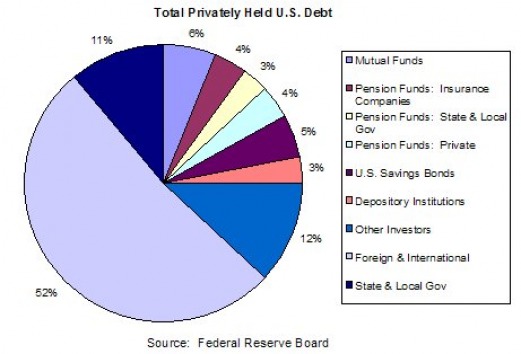

The United States consumes more than any other country. In fact, on average 70% of the United States GDP is made up of individual consumption based on numbers provided by the Bureau of Economic Analysis. With such staggering needs for consumer goods, the United States is unable to produce as many goods as people want to buy, leading to growth in imports, in this case, at a rate highly exceeding exports. When other countries sell goods to the United States, they are paid in U.S. Dollars. As other countries hold more U.S. currency, they choose to invest this money back into purchases they can make with U.S. dollars, such as U.S. treasuries, which provide higher rates of return than simply depositing the cash in the bank. This creates a constant lending stream to the U.S. government from international lenders. While foreign investment makes up just over 50% of all private lending, the remaining private, domestic lending can be seen below. All private lenders to the U.S. government make up approximately 48% of U.S. debt. The rest of U.S. debt is in fact held by the U.S. federal reserve and government programs.

- Trade deficit - importing more than the country is exporting

- Excessive government spending without increased revenues

The United States consumes more than any other country. In fact, on average 70% of the United States GDP is made up of individual consumption based on numbers provided by the Bureau of Economic Analysis. With such staggering needs for consumer goods, the United States is unable to produce as many goods as people want to buy, leading to growth in imports, in this case, at a rate highly exceeding exports. When other countries sell goods to the United States, they are paid in U.S. Dollars. As other countries hold more U.S. currency, they choose to invest this money back into purchases they can make with U.S. dollars, such as U.S. treasuries, which provide higher rates of return than simply depositing the cash in the bank. This creates a constant lending stream to the U.S. government from international lenders. While foreign investment makes up just over 50% of all private lending, the remaining private, domestic lending can be seen below. All private lenders to the U.S. government make up approximately 48% of U.S. debt. The rest of U.S. debt is in fact held by the U.S. federal reserve and government programs.

On the other hand, the United States government spending exceeded its revenues over the last decade. While President Clinton was able to accomplish a balanced budget by the end of his tenure, the Wars in Iraq and Afghanistan caused a need for increased expenditures by the U.S. government with little revenue coming in to replace it. The budget can either be balanced by increasing revenue through taxation or by cutting spending to match the current revenue stream.

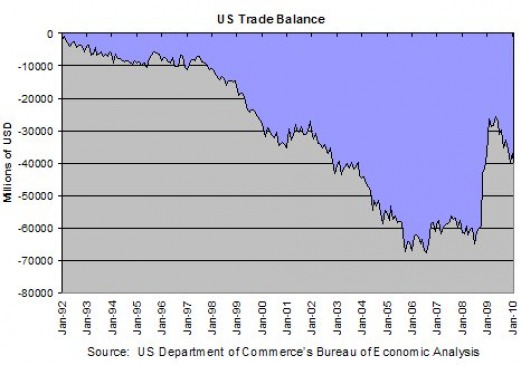

The US trade deficit since 1992 can be seen in the graph below.

The US trade deficit since 1992 can be seen in the graph below.

Current State of U.S. Debt Programs

On February 18, 2010, President Obama issued an executive order, creating the National Commission on Fiscal Responsibility and Reform (more commonly known as the Debt Commision). The Commission has been charged with identifying policies that will help to achieve medium- and long-term sustainability as well as balancing the budget and seeking measures to assist in reducing the gap between projected revenues and expenditures. Ultimately, the goal of this eighteen member group is to find specific ways in which the U.S. Government can reduce spending, thus allowing the United States to pay off its existing debt and to minimize future borrowings. The final recommendations from the Debt Commission shall be submitted to the Executive Office of the President by December 1, 2010.

While this bipartisan commission reports directly to the President, it is still a politically charged committee. According to a Washington Times article, U.S. House Minority Leader, John Boehner, has asked for the commission to attempt to complete their final report no later than October 1, 2010. His goal is to have the commission's reconmmendations into Congress to be considered prior to the mid-term elections. Boehner expressed his concern that if the report does not arrive until December 1st Congress will have started its post-election lame duck period and would be unable to legislate and fulfill any recommedations provided by the Debt Commission prior to the start of 2011.

While this bipartisan commission reports directly to the President, it is still a politically charged committee. According to a Washington Times article, U.S. House Minority Leader, John Boehner, has asked for the commission to attempt to complete their final report no later than October 1, 2010. His goal is to have the commission's reconmmendations into Congress to be considered prior to the mid-term elections. Boehner expressed his concern that if the report does not arrive until December 1st Congress will have started its post-election lame duck period and would be unable to legislate and fulfill any recommedations provided by the Debt Commission prior to the start of 2011.

Analysis of Sustainability

Thus far, U.S. debt appears to be in fact sustainable. But if the United States wishes to continue to borrow from its wide array of lenders, as shown above, it must be capable of showing all lenders that the U.S. government is capable of proactively keeping lending to a minimum.

A key to better understanding what impacts the sustainability of U.S. debt is to consider not whether the United States will be willing to pay its debt, but more importantly how long will others be willing to lend. The way in which a lender perceives the United States willingness to pay impacts how much they will be willing to lend. At the end of the day, the United States is a sovereign country that can decide to not pay another country or lender with little or no legal ramifications. The United States has the ability to print its own money if need be to pay back lenders, and the separation of the Federal Reserve from the U.S. government is crucial to maintain the ability to print money. Nonetheless, printing money can lead to inflation, which must be actively monitored by all parties. Factors that influence whether or not a lender will be concerned about a country’s willingness to pay can include whether:

1. GDP is growing fast and large enough to sustain debt.

2. A country is willing to raise taxes to reduce deficit.

3. A country is willing to cut government spending.

As was discussed previously, the United States is actively trying to balance its budget, with the aid of the U.S. debt commission. But it must be remembered that balancing the budget is a political game. If political parties are unable to come together and prove their ability to work in a bipartisan manner to balance the budget then lenders may in fact no longer see the United States capable of paying back loans. In order for U.S. debt to remain stable and sustainable, the United States government must actively show its ability to balance the budget and act in a manner that is best for all, regardless of party lines.