Background

China has become increasingly integrated into the world. In fact, it has become a major player in global economy and is one of the most important markets to the United States. For this reason, we have looked into China's current situation and its stimulus package.

After enjoying five years of annual GDP growth in excess of 10%, the Chinese economy has been declining the past couple years. In response to its weakening economy, China announced a $586 billion USD stimulus package on November 9, 2008. Beijing stated that the stimulus package would focus on 10 sectors of the Chinese economy, including rural infrastructure and healthcare, with the goals of creating jobs and increasing the Chinese GDP. As part of the stimulus package, China also announced a proactive fiscal policy, which encourages state-owned banks to loosen credit and lend more freely, thereby avoiding the credit freeze experienced in Western countries.

After enjoying five years of annual GDP growth in excess of 10%, the Chinese economy has been declining the past couple years. In response to its weakening economy, China announced a $586 billion USD stimulus package on November 9, 2008. Beijing stated that the stimulus package would focus on 10 sectors of the Chinese economy, including rural infrastructure and healthcare, with the goals of creating jobs and increasing the Chinese GDP. As part of the stimulus package, China also announced a proactive fiscal policy, which encourages state-owned banks to loosen credit and lend more freely, thereby avoiding the credit freeze experienced in Western countries.

The Facts

China's stimulus package is $586 billion USD to encourage growth. The Central Government will fund 25% of the stimulus, while other funding will come from local governments and the private sector.

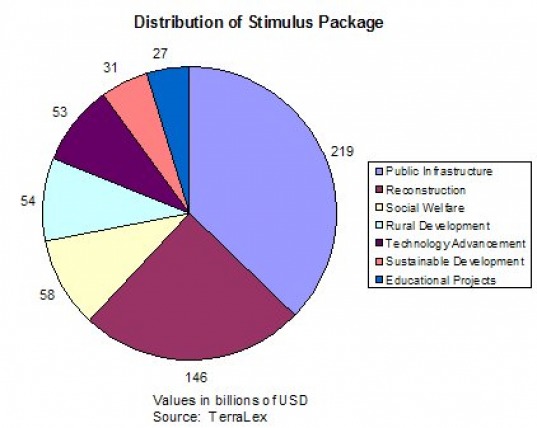

The distribution of money can seen in the graph below.

The distribution of money can seen in the graph below.

Current State of China's Stimulus Package

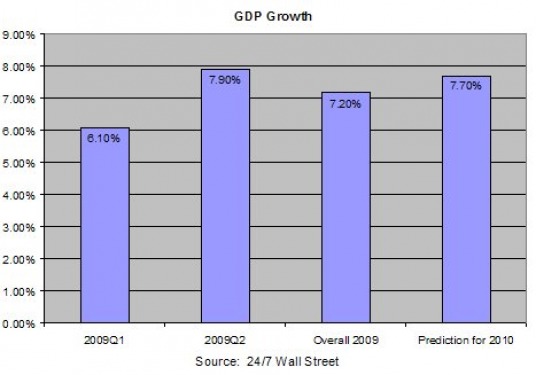

China’s GDP grew at a rate of 6.10% in the first quarter of 2009. A Financial Times article dated August 25, 2009 puts the GDP growth rate at 7.90% in the second quarter. Many analysts now predict that China’s full-year growth rate will be close to Beijing’s stated goal of 8%. The World Bank estimates the GDP growth for China at 7.20% for the entire year of 2009 and 7.70% in 2010. Internal investment has already started rising, a direct result of the stimulus package. The growth in GDP can be seen in the graph below.

There is also a direct affect on the private sector. Under the Chinese government mandate, banks authorized a significant number of loans in the first quarter of 2009, almost equal to all of the loans made in 2008. This $670 billion of fresh funds has sparked new growth in domestic investment, reversing negative sentiment about China's growth potential. The stock markets have also shown signs of recovery - the Shanghai composite index has posted a 38% gain since the start of the year.

With China's massive manufacturing sectors forming a considerable share of its economy, it consumes a tremendous amount of raw materials. As factories ramp up production, this demand will be welcomed by the global economies that supply to China.

Car sales have had record figures for 3 consecutive months and are outpacing the US in terms of sheer numbers (EconomyWatch). Housing starts are on the rise too, as the market seems to be hitting bottom. This has resulted in contagious positive consumer confidence.

With China's massive manufacturing sectors forming a considerable share of its economy, it consumes a tremendous amount of raw materials. As factories ramp up production, this demand will be welcomed by the global economies that supply to China.

Car sales have had record figures for 3 consecutive months and are outpacing the US in terms of sheer numbers (EconomyWatch). Housing starts are on the rise too, as the market seems to be hitting bottom. This has resulted in contagious positive consumer confidence.

Analysis of Sustainability

The suddenness with which the Chinese stimulus has worked may be a testament to the benefits of having a central, totalitarian government. It also points to the fact that the plans for the stimulus package of the world's most populous nation are not long term. China appears to be gambling with the sustainability of its economy for another year, and global improvements will kick in, supplying the necessary demand for goods to make the recovery permanent.

According to E-to-China, the proactive fiscal policy has had remarkable results by promoting steady and rapid economic development. The government's fiscal spending favored the people's livelihood and increased public investment.

According to E-to-China, the proactive fiscal policy has had remarkable results by promoting steady and rapid economic development. The government's fiscal spending favored the people's livelihood and increased public investment.