Background

The point of this page is to give readers a greater understanding of current state of the U.S. economy, and the actions taken in the last few years to combat the recession. In the decade leading up to the current financial crisis beginning in 2007, the average price of a U.S. house increased by more than 100%. Lenders developed a mentality that the housing market could only go up, causing a wave of refinancing and increased sub-prime lending. Under-regulated greedy lending led to a spike in toxic asset borrowing. In 2008 when housing began to decrease in value, the housing, business, and financial sectors of the economy were all highly overleveraged creating a liquidity shortage. Borrowers who found themselves unable to escape higher monthly payments by refinancing began to default.

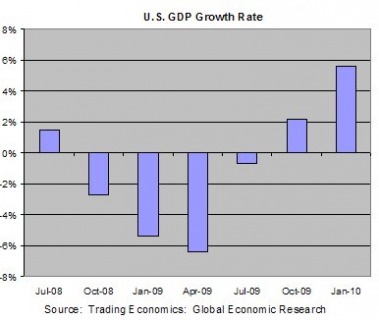

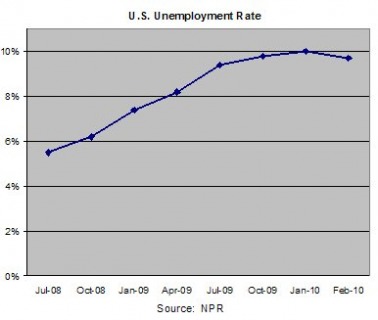

At the time of Obama’s inauguration, The Great Recession was in the most threatening stages of a total financial meltdown. Unemployment was steadily rising and beginning to approach 10%, the highest in a quarter of a century. The United States saw consistent output shrinking throughout the second half of 2008, peaking in the first half of 2009 with a first quarter decline in GDP of 6.4%. Auto sales had dropped to their lowest in a decade with bankruptcy looming over America’s “Big 3” automobile manufacturers. The previous administration under President Bush had taken extreme legislative measures in an attempt to save our crumbling financial system. Due to the overwhelming rise in defaulting mortgages the government took control of Fannie Mae and Freddie Mac and prepared to spend as much as was necessary to save the housing market. In October of 2008 President Bush signed off on the E.E.S.A. of 2008 to relieve and stimulate the struggling financial sector. The E.E.S.A. gave birth to T.A.R.P. giving the U.S. Treasury approval to spend $700 billion to purchase distressed assets, especially mortgage backed securities, and inject capital into domestic and foreign banks. Needless to say, it was an era of turmoil and uncertainty.

At the time of Obama’s inauguration, The Great Recession was in the most threatening stages of a total financial meltdown. Unemployment was steadily rising and beginning to approach 10%, the highest in a quarter of a century. The United States saw consistent output shrinking throughout the second half of 2008, peaking in the first half of 2009 with a first quarter decline in GDP of 6.4%. Auto sales had dropped to their lowest in a decade with bankruptcy looming over America’s “Big 3” automobile manufacturers. The previous administration under President Bush had taken extreme legislative measures in an attempt to save our crumbling financial system. Due to the overwhelming rise in defaulting mortgages the government took control of Fannie Mae and Freddie Mac and prepared to spend as much as was necessary to save the housing market. In October of 2008 President Bush signed off on the E.E.S.A. of 2008 to relieve and stimulate the struggling financial sector. The E.E.S.A. gave birth to T.A.R.P. giving the U.S. Treasury approval to spend $700 billion to purchase distressed assets, especially mortgage backed securities, and inject capital into domestic and foreign banks. Needless to say, it was an era of turmoil and uncertainty.

The Facts

The recession lasted longer than anticipated, hitting hardest in mid 2009.

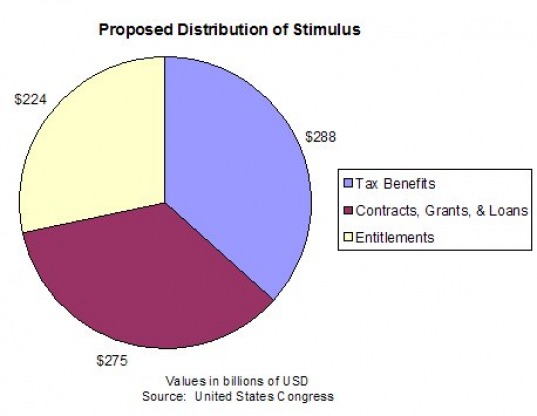

The proposed distribution of the stimulus can be seen in the graph below.

- Unemployment peaked in October 2009 at just over 10%

- GDP saw its largest shrinkage in early 2009 of -6.3%

- Tax Benefits

- Contracts, Grants, & Loans

- Entitlements

The proposed distribution of the stimulus can be seen in the graph below.

Current State of the U.S. Stimulus Plan

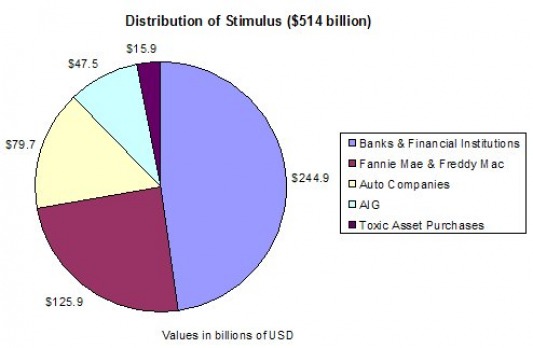

To date, $514 Billion of the $787 Billion from the T.A.R.P. has been spent, invested, or loaned in various ways. The distribution of these funds can be seen in the graph below.

Of the $514 Billion injected, $207.3 Billion has been returned or paid to the Treasury as interest, dividends, fees or to repurchase their stock warrants.

Because the recession lasted longer than expected we did not see much economic reaction to the stimulus at first, but we are finally starting to see some changes in numbers. Unemployment has dropped from the 10.1% we saw in October of 2009 to 9.7% in March of 2010. Since the Recovery Act, GDP is yet to contract and in the fourth quarter of 2009 there was a 5.6% annualized increase. Market wide deleveraging has created safer lending practices and cut down on U.S. private debt considerably. Job creation and protection is now the number one concern of administrators, and without a greater drop in unemployment the economy will remain at risk and continue to suffer.

Analysis of Sustainability

One year after the enactment of The Recovery Act Obama claimed that they have halted the possibility of a 2nd recession, and that they are on track to create/preserve 1.5 million jobs within the next two years. The statistics show a flattening out in unemployment and positive growth in GDP for late 2009 and early 2010. It appears as though the stimulus is starting to take effect, but the increase in economic output is partially due to increased inventories from stimulus money. Drops in unemployment may take years to take place because it will take time for the stimulus money to translate into economic growth. Deleveraging has helped to stabilize the economy, but public debt has become the concern for the future. In 2009 alone, Federal government debt rose almost 23% as they continued to relieve debt and inject capital. Once stimulus spending has run out and the government feels comfortable with the state of the economy we will begin to focus more on the increased public debt. Without consistent economic expansion our debt will continue to grow and could easily force us back into another era of crisis. The main concern as of right now should be unemployment. If we cannot successfully decrease the number of jobless Americans then economic expansion will be more and more difficult.